New GST rates list 2025: Full list of items with revised rates effective from Navratri, September 22

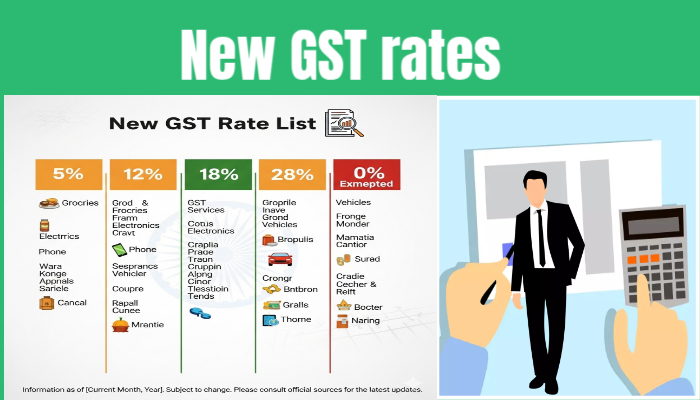

New GST rates List 2025: Full List of Items with Revised Rates Effective from Navratri, September 22 The Goods and Services Tax (GST) is one of the most important indirect taxes in India. Since its launch in 2017, it has undergone several revisions to simplify the system and reduce the burden on common people. In 2025, the government has introduced a major change known as the New GST rates Reforms 2025. These reforms bring a new structure of tax slabs, making GST simpler, fairer, and easier to follow. The revised rates will officially take effect from Navratri, September 22, 2025. This blog will explain the details of the new GST rates, the categories of goods and services affected, and why these changes matter for consumers and businesses. New GST rates Reforms 2025: What Has Changed? The New GST rates Reforms 2025 are the biggest transformation since the original GST rollout. Earlier, India had four main GST slabs—5%, 12%, 18%, and 28%. Many people found this system confusing, and businesses struggled with compliance.GST Reforms 2025 Blog: New Rates & Item List from Sept 22 From September 22, 2025, the GST Council has streamlined the tax structure into: 5% GST – For essentials and daily-use items 18% GST – For standard goods and services 40% GST – For luxury items and sin goods (such as tobacco, aerated drinks, and luxury vehicles) This new structure reduces complexity and focuses on fairness: everyday goods are taxed lightly, while luxury items bear higher taxes. GST Rate Cut Updates: New GST Rates, Applicable Date The GST rate cut updates: new GST rates, applicable date are designed to boost spending and make life easier for the middle class. With September 22, 2025 as the applicable date, these reforms arrive just in time for the festive season. Families will benefit from lower costs during Navratri, Diwali, and the holiday shopping period. Key highlights include: Essentials like milk, bread, and medicines are either tax-free or fall in the 5% category. Travel, hotels, and restaurants now attract lower GST, making leisure more affordable. Automobiles, electronics, and cement have shifted from the high 28% slab to 18%. This reduction will not only increase consumer savings but also give businesses higher sales volumes. GST Rates in 2025 – List of Goods and Service Tax The government has published New GST rates in 2025 – List of Goods and Service Tax slabs so that everyone clearly understands which products fall into which category. 0% / Nil GST Fresh milk, paneer, bread, chapati, roti, paratha Life-saving medicines and cancer drugs Life and health insurance policies 5% GST FMCG goods: soap, shampoo, toothpaste, butter, coffee, chocolates Processed foods and packaged snacks Budget hotels, restaurants, and economy class air tickets 18% GST Large appliances like refrigerators, dishwashers, and air conditioners Mid-range cars, motorcycles, and auto parts Services such as telecom, broadband, and higher-end restaurants 40% GST (Luxury / Sin Goods) Tobacco, gutkha, pan masala, cigarettes Aerated and carbonated beverages Yachts, helicopters, and luxury automobiles By reducing rates on essential goods and increasing them on luxury products, the government balances affordability with revenue needs. New GST rates in India 2025: Updated List of Tax Slabs The New GST rates in India 2025: Updated List of Tax Slabs is simpler compared to the earlier system. Instead of multiple confusing layers, there are only two main rates plus one luxury slab. 5% Slab: Focused on essentials and services for the common man. 18% Slab: Covers most goods and services that are not luxury items. 40% Slab: Reserved for luxury and sin goods to discourage over-consumption. This system improves transparency, reduces compliance costs for businesses, and makes taxation easier for consumers to understand. What Is New GST rates India 2025? Many people ask, “What is new GST rate India 2025?” The answer is simple: Essentials = 0% to 5% Standard goods = 18% Luxury/sin goods = 40% Effective date = September 22, 2025 The reform ensures that basic necessities are either tax-free or very lightly taxed, while luxury items that only a few can afford are taxed heavily. This makes the system more equitable for all sections of society. How Will GST Reforms 2025 Impact Consumers? For consumers, these reforms mean: Lower costs for groceries, medicines, and household essentials Cheaper travel and dining due to reduced hotel and restaurant GST Affordable vehicles and appliances as taxes on cars and electronics come down Families will notice the difference during festival shopping when their bills are lower than before. How Will GST Reforms 2025 Impact Businesses? For businesses, the new structure: Reduces paperwork and compliance burdens Boosts sales due to increased consumer demand Encourages investment in sectors like real estate, travel, and FMCG By cutting the 28% slab, industries like cement and automobiles are expected to see a strong revival. Why the Timing Matters The government chose Navratri, September 22, 2025 as the effective date for a reason. Festivals in India are times of high spending. By reducing GST rates before Navratri and Diwali, the government aims to: Stimulate the economy through higher consumption Provide relief to households ahead of festive expenses Send a strong message of pro-consumer reforms Summary Table of New GST rates in 2025 Category New GST Rate Example Items Essentials 0% – 5% Milk, roti, medicines Standard Goods/Services 18% Cars, electronics, telecom Luxury/Sin Goods 40% Tobacco, luxury cars, yachts Conclusion The GST Reforms 2025 represent a bold and consumer-friendly move by the government. With a simplified structure and fewer slabs, the tax system becomes easier to manage. The New GST rates cut updates: new GST rates, applicable date of September 22, 2025, ensure that citizens feel the benefits right during the festive season. By studying the GST Rates in 2025 – List of Goods and Service Tax, and the GST Rates in India 2025: Updated List of Tax Slabs, one can see how the government has balanced affordability with revenue. So, what is new GST rate India 2025? It is a fairer, simpler system with 5%, 18%, and 40% slabs designed